Avoiding Financial Catastrophe (and big mistakes!)

- Doug Oosterhart, CFP®

- Nov 21, 2022

- 3 min read

If you've watched any financial news over the past couple of weeks, you've heard a lot about the crypto world as it has now completed the entire cycle from mania-bubble to meltdown and fraud.

It’s intuitive that a big part of financial and investing success is the avoidance of financial catastrophe. And avoiding catastrophe mostly consists of avoiding manias and questionable investments as this cycle illustrates. This has been the story of every bubble that has come before and will be again for every bubble yet to come.

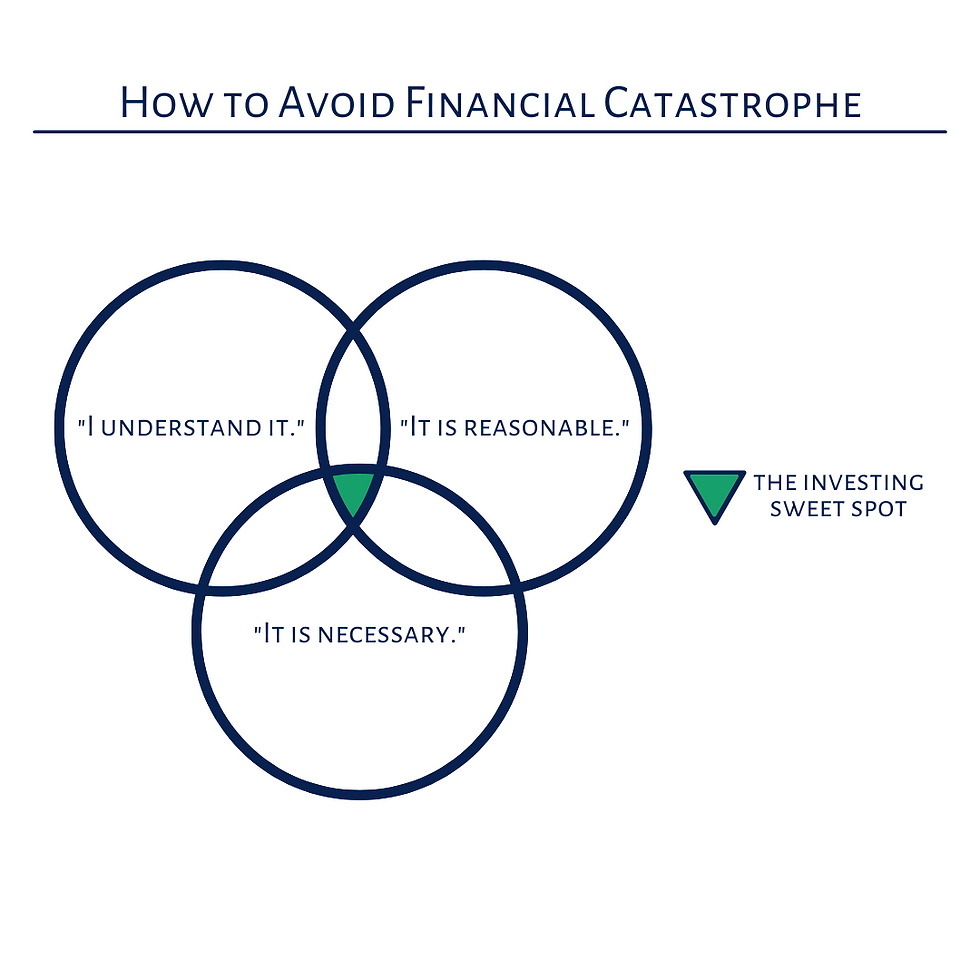

With this boom-to-bust cycle now complete, I want to use it as an opportunity to share/review the intentionally simple three-question framework you can use to, hopefully, avoid making regrettable investing decisions. Obviously, there is no framework that is guaranteed to work 100% of the time, but I think this framework can help us avoid the large majority of questionable investments.

In abiding by this framework, the rule is simple: If I can't answer each question below with a confident "Yes," then I will not invest [1]. Here we go.

Question #1: Do I understand the investment? (Or is it confusing?)

As crypto went mainstream over the last couple of years, I took a lot of time to read and learn about the space. I even became an advisor that is certified in digital assets. That said, even though I understand how it works, and what some of the use cases were and could be down the road, there is always the "what-if" factor. What if the adoption of crypto stalled? How would prices continue to rise? Would they fall?

Many have said that crypto is a solution in search of a problem. After much research, I mostly agree with that assessment though I continue to reevaluate this position.

Until clarity is obvious, Warren Buffett's "too hard pile" philosophy can be helpful here. If I can't understand it, I probably shouldn't own it.

For the most part, that is true. However, there are some investors in the marketplace that use 1-2% of their portfolio for speculative investments. Currently, crypto is still in the "speculative" category and any investment should be carefully considered.

*********

Question #2: Is it reasonable? (Or does it sound too good to be true?)

Many investors who eventually decided to invest in crypto did so because crypto “savings accounts” were offering very high yields with minimal risk. At least, that’s how they were advertised. And due to minimal regulation in the space, there were few disclaimers offered to protect consumers from any misrepresentation of the risk that was involved.

What’s great about free markets is that they are a natural pricing mechanism for risk. Because of this price/risk relationship, I couldn't see how a high-yield, low-risk account could truly exist which further encouraged my skepticism.

Given my lack of understanding for how the yield was generated (see Question #1 again), I continued to return to the sage phrase we’ve all heard a thousand times before, "If it sounds too good to be true, it probably is."

Instead of a high-yield, low-risk opportunity, the reality was that it was more like getting a dividend on a massively volatile small-cap growth stock (which is an oxymoron since small-cap growth stocks don't pay dividends). The takeaway here is that due diligence is important when making decisions. Even if high-profile famous people are vouching for a product, nothing will replace your own due diligence process.

*********

Question #3: Is it necessary to achieve my financial goals? (Or is it a distraction?)

If they're honest, I would guess many people who invested in crypto did so because it seemed like easy money. But we know that money easily gained is easily lost.

As a good rule of thumb, the more exciting an investment seems, the more likely it is to blow up. Though, in the midst of a mania, it's easy to forget this.

When considering this third question, we can disregard most investment opportunities because almost everything that is new or exciting is a distraction from what has worked for decades upon decades. Consider this wisdom from Nick Murray,

"Don't ask what's working right now; ask what has always worked."

The answer is typically a diversified portfolio of traditional, boring, low-cost investments. The rest just isn’t necessary.

*********

To be fair, this memo isn't designed to be anti-crypto. My intent is to share a decision-making process you can follow when making any and every investment decision and I am using crypto as my obvious example given its prevalence in the current news cycle.

One thing we know is that we’ll experience another bubble at some point. We don’t know what that will be, but my hope is that these questions can serve as a helpful filter to avoid falling victim to whatever comes next.

[1] Obviously, answering yes to all three questions does not mean we should invest in the opportunity being evaluated. The questions are merely a filter to help us avoid potentially regrettable investments.

Comments