It's "Official"

- Doug Oosterhart, CFP®

- Jun 16, 2022

- 2 min read

Bear market 2022 is now official as it has crossed the magic 20% threshold. For what it’s worth, this 20% threshold is quite arbitrary as I tend to agree with Howard Marks,

"Does it really matter whether the S&P 500 is down 19.9% or 20.1%? I prefer the old-school definition of a bear market: nerve-racking."

I would say today’s market qualifies under either definition. That said, I’ll admit that I am thankful it has finally closed down more than 20% so that the media can stop droning on about semantics and move on to more relevant issues.

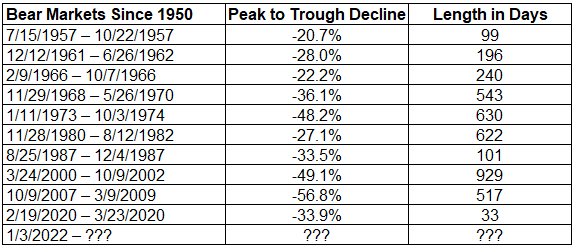

In the spirit of Churchill’s idea that, “The farther back you can look, the farther forward you are likely to see.” I thought it might be helpful to put today’s market into historical perspective. Below is the list of all bear markets since 1950.

One thing is certain and that’s that each one of these events was nerve-racking and scary. But there are a couple of observations we can draw from this list.

First is that there have been eleven occurrences when the market has fallen by at least 20% during this period (and many more where it has come close, but again, semantics). That means this has happened about once every six years. In other words, this type of downturn is quite common.

While quite common, it would be understandable if it doesn’t feel that way because the 2020 bear lasted a mere 33 days, meaning the most recent significant bear market experience started 15 years ago. Unlike the brief COVID bear, we are already 165 days into this one and with current inflation, we’re all feeling its effects.

The second observation has to do with what has happened in between each of these bear market events. This is something that no media pundit likes to discuss in the throes of a sell off because, of course, bad news brings more viewers. But it’s easy to see what has happened by noting the bear market bottom prices in each of these eleven bear markets. Let’s take a look:

Since the bear market trough of 1957 to where we stand today at 3,780 as I write this (even after a ~20% drawdown), the market is up 97 times! Amazingly, it’s important to note that none of the prices above include the compounding benefit of dividends that so richly rewards permanent owners of equities like us. Sorry for stating the obvious, but that is a wild amount of growth.

If 1957 is too distant of a memory for you, the market is still up almost six times from the 2009 bottom to the current trough of today’s bear market point. The point here is that all that was required to fully participate in this tremendous growth was the patience to endure all the bumps along the way. This time is no different.

As we look toward the future, there are many pundits willing to give their prediction for when this will end, but nobody knows for sure. We can only observe that, based on historical fact, every single one we’ve ever experienced has come to an end, eventually.

And then, as history has shown, gone on to reward the patient. This too shall pass.

Comments